Delving into the fine print pay stub answer key, we embark on a journey to decipher the intricacies of our earnings. This enigmatic realm holds the key to understanding our deductions, withholdings, and the all-important net pay.

Within this comprehensive guide, we’ll navigate the maze of information hidden in the fine print, empowering you to make informed financial decisions and maximize your earnings.

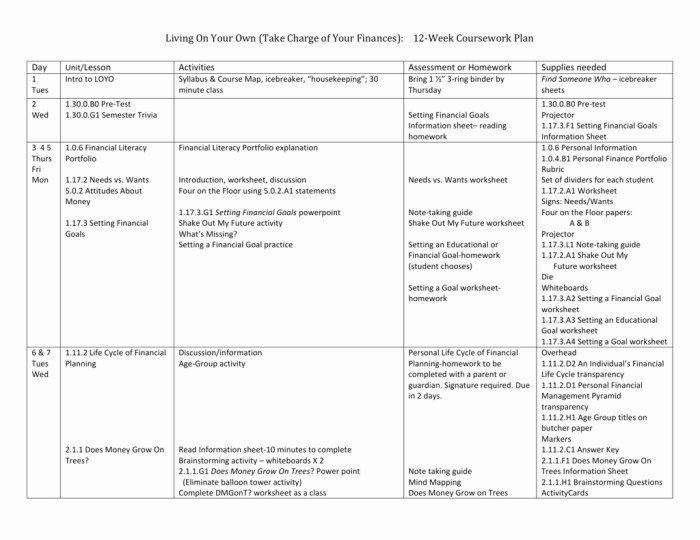

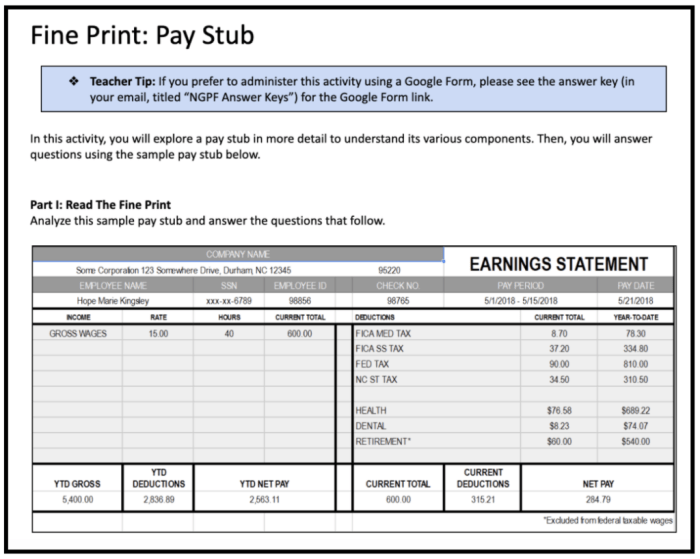

Fine Print on Pay Stubs

The fine print on a pay stub may seem insignificant, but it contains important information that employees should carefully review. This information can include details about deductions, benefits, and other aspects of an employee’s compensation.

Types of Information in Fine Print

- Deductions:These are amounts taken out of an employee’s pay before taxes are calculated. Common deductions include health insurance premiums, retirement contributions, and union dues.

- Benefits:The fine print may also include information about benefits offered by the employer, such as health insurance, paid time off, and retirement plans.

- Tax Information:The fine print will typically include information about the amount of taxes withheld from an employee’s pay, such as federal income tax, Social Security tax, and Medicare tax.

- Other Information:The fine print may also include other information, such as the employee’s pay rate, hours worked, and overtime pay.

Importance of Reviewing Fine Print

It is important for employees to carefully review the fine print on their pay stubs to ensure that all deductions and benefits are correct. Errors can occur, and it is the employee’s responsibility to bring any discrepancies to the attention of their employer.

Additionally, the fine print can provide valuable information about an employee’s compensation and benefits package. By understanding the details of their pay stub, employees can make informed decisions about their financial future.

The fine print on a pay stub can be a bit tricky to decipher, but it’s important to understand what it all means. For example, if you’re trying to figure out what a particular deduction is for, you can check the believed to be crossword clue to see if it’s a common deduction.

This can help you understand your pay stub better and make sure you’re getting paid correctly.

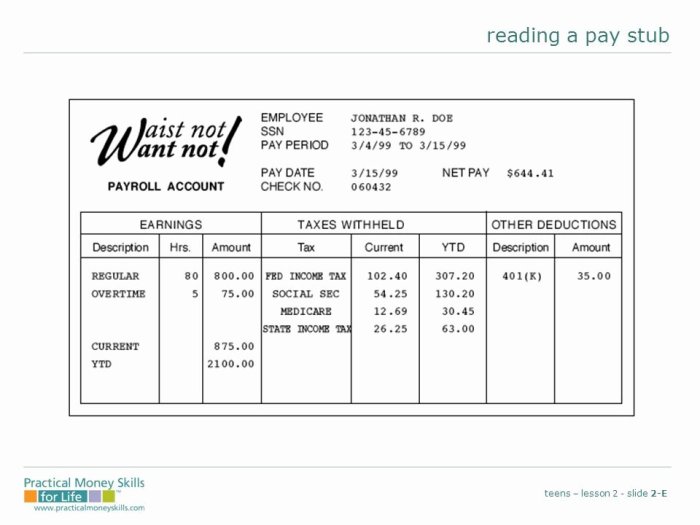

Understanding Deductions and Withholdings: Fine Print Pay Stub Answer Key

Understanding deductions and withholdings is crucial for deciphering your pay stub. Deductions reduce your gross pay, while withholdings are amounts withheld from your paycheck for taxes. These deductions and withholdings are used to fund various programs and services.

Types of Deductions and Withholdings

| Deduction/Withholding | Description |

|---|---|

| 401(k) Contributions | Retirement savings plan |

| Health Insurance | Medical coverage |

| Dental Insurance | Oral healthcare coverage |

| Federal Income Tax | Tax withheld for federal income |

| State Income Tax | Tax withheld for state income |

| Social Security Tax (FICA) | Retirement and disability insurance |

| Medicare Tax (FICA) | Hospital insurance |

Minimizing Deductions and Withholdings, Fine print pay stub answer key

While it’s not always possible to eliminate deductions and withholdings, there are strategies to minimize them:

- Contribute to retirement plans strategically, considering tax implications.

- Negotiate lower health insurance premiums with your employer.

- Explore flexible spending accounts (FSAs) to save on healthcare expenses.

- Claim tax deductions and credits when filing your tax return.

Analyzing Net Pay

Net pay is the amount of money an employee receives after all deductions and withholdings have been taken out of their gross pay. It is the amount of money that is deposited into the employee’s bank account or paid to them in cash.

To calculate net pay, you need to start with the employee’s gross pay. This is the total amount of money that the employee earned before any deductions or withholdings are taken out. Once you have the employee’s gross pay, you need to subtract all of the deductions and withholdings that apply to the employee.

Deductions

Deductions are amounts of money that are taken out of an employee’s gross pay before taxes are calculated. Common deductions include:

- Health insurance

- Dental insurance

- Vision insurance

- Retirement savings

- Union dues

- Child support

Withholdings

Withholdings are amounts of money that are taken out of an employee’s gross pay to pay for taxes. Common withholdings include:

- Federal income tax

- State income tax

- Social Security tax

- Medicare tax

Once all of the deductions and withholdings have been taken out of the employee’s gross pay, the remaining amount is the employee’s net pay.

You can use the fine print on your pay stub to verify your net pay calculations. The fine print will show you a breakdown of all of the deductions and withholdings that were taken out of your gross pay. You can also use the fine print to see how much money was deposited into your bank account or paid to you in cash.

Understanding how net pay is calculated can help you to budget your money and plan for the future.

Identifying Errors on Pay Stubs

Reviewing your pay stub is crucial to ensure you’re being compensated correctly. Errors on pay stubs can occur, so it’s essential to know how to identify and address them.

Common errors on pay stubs include incorrect calculations, missing deductions or withholdings, and discrepancies in hours worked.

Step-by-Step Guide to Identifying Errors

- Compare your pay stub to your timecard:Verify that the hours worked and the pay rate match.

- Review your deductions and withholdings:Check if they align with your employee benefits and tax information.

- Calculate your net pay:Subtract your deductions and withholdings from your gross pay. The result should match the net pay on your pay stub.

- Check for any unusual or unexplained entries:If you notice anything unfamiliar, investigate further.

Steps to Take if an Error is Found

- Contact your payroll department:Politely inform them about the error and provide supporting documentation, such as your timecard or a copy of your pay stub.

- Follow up:Stay in communication with payroll to ensure the error is resolved promptly.

- Keep records:Maintain copies of your pay stubs and any correspondence related to the error.

Using Fine Print for Financial Planning

The fine print on your pay stub provides valuable information that can help you make informed financial decisions. By understanding the deductions and withholdings listed on your pay stub, you can create a budget that works for you and start saving money.

Benefits of Using the Fine Print for Financial Planning

There are many benefits to using the fine print on your pay stub for financial planning. These benefits include:

- You can identify areas where you can cut back on spending.

- You can track your income and expenses more accurately.

- You can make better decisions about how to invest your money.

- You can avoid financial surprises.

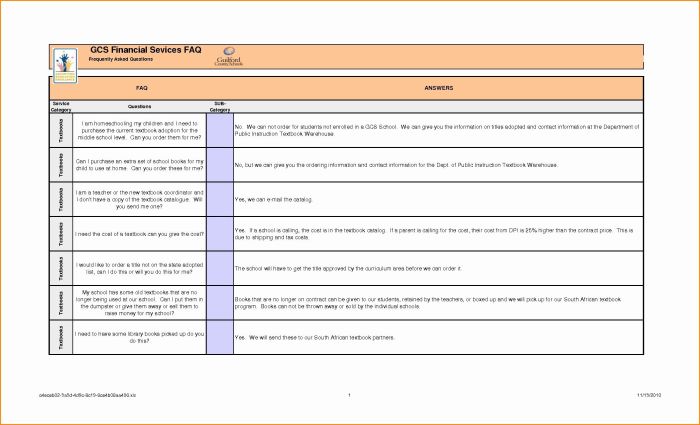

Common Queries

What is the purpose of the fine print on a pay stub?

The fine print provides detailed information about deductions, withholdings, and other adjustments made to your gross pay, helping you understand how your net pay is calculated.

What are some common types of deductions?

Common deductions include taxes (federal, state, and local), Social Security, Medicare, health insurance premiums, and retirement contributions.

How can I minimize deductions and withholdings?

Review your withholding allowances and consider adjusting them if necessary. Explore eligible deductions, such as contributions to retirement accounts or charitable donations.